The Mortgage Process

Learn how the mortgage process works in three simple steps and how to secure financing for your dream home in as little as just 30 days.

By Steve Mann

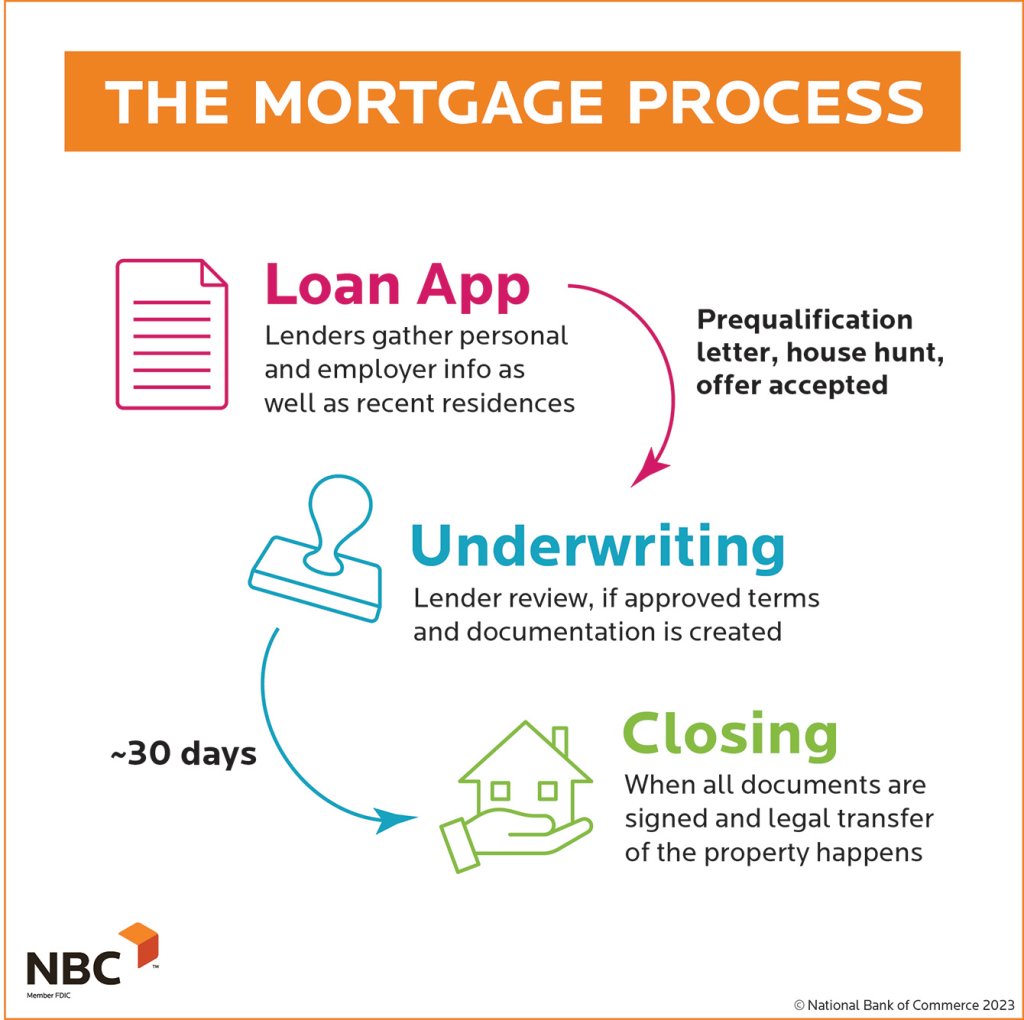

Here’s the good news: The mortgage process is relatively simple! In fact, it can be broken down into three basic steps.

- First, a customer qualifies for a mortgage through a lender or bank by filling out a loan application.

- After finding the right property or house, the loan process officially begins with underwriting, where we examine the customer’s creditworthiness and the property they are trying to purchase.

- Finally, we complete the closing process, which is where legal documents are signed to transfer ownership to the buyer and finalize the financial commitment to pay for the property over the chosen terms. This step of the process typically takes about 30 days.

1. Loan Application

Let’s start with the qualification process. Generally, you fill out an application online or meet with a lender to complete the application. The application gathers your personal information, such as name, date of birth, and social security number. You will typically be asked for your current address for the past two years. This helps to establish a housing payment history. Additionally, you will need to provide your employer/s name and contact information.

Application Checklist

Here are items and/or documents you’ll need to have ready when you fill out your application.

- Two years’ worth of W-2s for all borrowers listed on the application

- Recent pay stub

- Two months of bank statements for all asset accounts used

- Name and contact information of current landlord (if applicable)

Once lenders have this information, they can move forward with the loan application and determine whether or not you qualify.

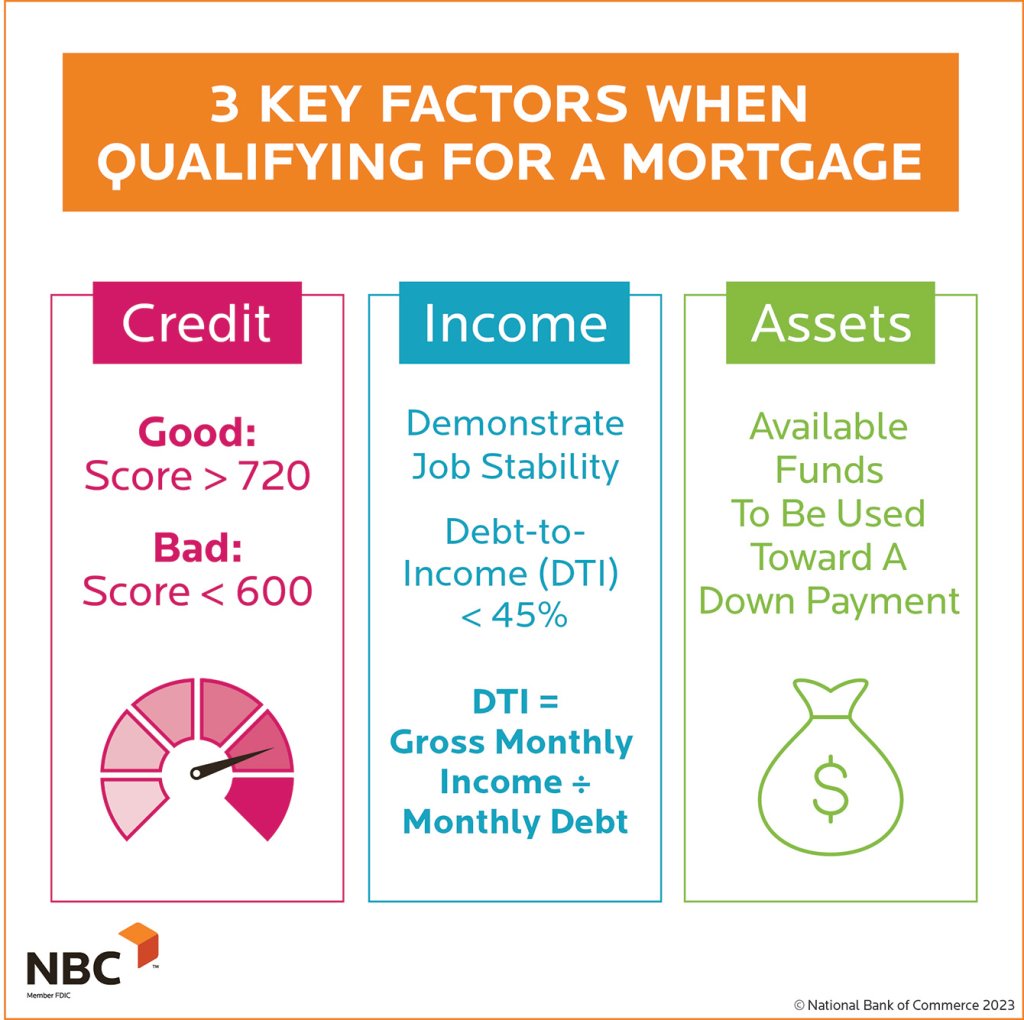

How Lenders Determine Eligibility

- Credit Profile – First, lenders pull a credit report for all applicants listed on the loan application. We pull a credit report from all three major credit bureaus—TransUnion, Equifax, and Experian. Most lenders take the middle of the three and, if there are two borrowers, we take the lowest middle score.

- Income – Lenders typically need two years of work history for income qualification.

- Assets & Savings – This is needed to show funds for down payment and closing costs, and sometimes helps with qualifying for a loan.

We also use the credit report to see what monthly obligations and expenses the borrower has to calculate their DTI and PITI ratios.

» For more details on these factors, refer back to Module 2: What Can I Afford & How Do I Qualify?

Pre-Qualification Letter

After lenders review all the information and it is deemed satisfactory an approval can be issued to the buyer. This is generally a letter that they can provide to a realtor. This shows the realtor and any seller that they are ready to buy a home and have the financial backing of a lender. At this point, buyers can start shopping!

2. Mortgage Underwriting

The loan process phase officially begins when the buyer has found a home and has signed a contract with the intent to purchase. Once the lender gets the fully signed purchase contract, things get busy!

This starts with finalizing the loan application and terms for repayment. Amortization is a term used to establish equal installment payments. This can typically be done with 15, 20, or 30-year repayment options. Rate options are disclosed to buyers in terms of annual percentage rate (APR). If you take the rate, add closing costs to that, and then divide this number out over the agreed-upon term, you get APR.

Buyers then complete their application and disclosures. These are regulatory documents that show the consumer the costs involved in the transaction.

Title Report

Lenders will then order title work on the property or house that is being purchased. This is done to ensure the property or house can legally be transferred to the buyer and whether any other liens on the property will need to be satisfied. When it comes to the title company, the consumer can choose who they want to work with, or the lender can provide them with a few options to choose from.

Appraisal

The property will also be appraised. The lender will order the appraisal to establish a fair market value of the property. This is done by a third-party licensed appraiser. Appraisers will also be looking for any health or safety concerns with the property.

Inspection

The consumer can also request a home inspection. This is generally not required by lenders unless the purchase contract calls for one. The consumer would be responsible for ordering this themselves and the lender or realtor can provide a list of inspectors to choose from.

Final Loan Approval

Once all that is received, a credit underwriter will review all gathered information. They verify the creditworthiness of the buyer as well as review the title report and appraisal. This is done to make sure the whole transaction meets the regulatory requirements of the lender. Once approved, the file is ready for closing.

3. Closing

Closing is the final step of the journey. The lender and realtors will work with buyers and sellers to coordinate a closing date and time. Typically, this is done at a predetermined title company. This will happen three business days after the closing disclosure is sent to the consumer and signed. This will show the consumer the final closing costs and down payment required at the final closing. At this point, the seller also receives payment for their sale.

Closing Documents

This is when the legal transfer of the property from the seller to the buyer happens. The buyer also signs all the lender-required documents at this time. These will include the mortgage and promise to pay notes.

Once completed, the buyer owns the home.

How long is the typical mortgage process?

This process from underwriting to closing is usually 30 days.

How long does it take to get pre-approved for a mortgage?

If the consumer can provide income and asset information, this can be done on the same day.

Can I be denied a mortgage after being pre-approved?

Yes. If a consumer’s income changes or if they buy something with another payment it can adversely affect their ability to purchase a home.

Other Articles in this Guide

What is a Mortgage?

Learn about the components of a mortgage, who is involved, and gain clarity on this major milestone in your life.

How Much Can I Afford?

Learn how to qualify and determine how much you can afford. Your dream home may be closer than you think!

Types of Mortgages

The most common mortgage types explained. Explore and compare to find the option that best suits your needs.