Types of Business Loans

Common Loan Options for Businesses

Learn the differences between term loans, lines of credit, and real estate loans, as well as important insights into the other forms of lending available to your business.

When it comes to the flexibility and variety of business lending products, even your options have options. Since we know that access means little without information, part of our commitment to local, long-term support for our region’s business makers and creators is to provide education into the options you have for funding. Here then, are the major types of business loans, as well as important insights into the options you have to get capital and cash reserves for your business.

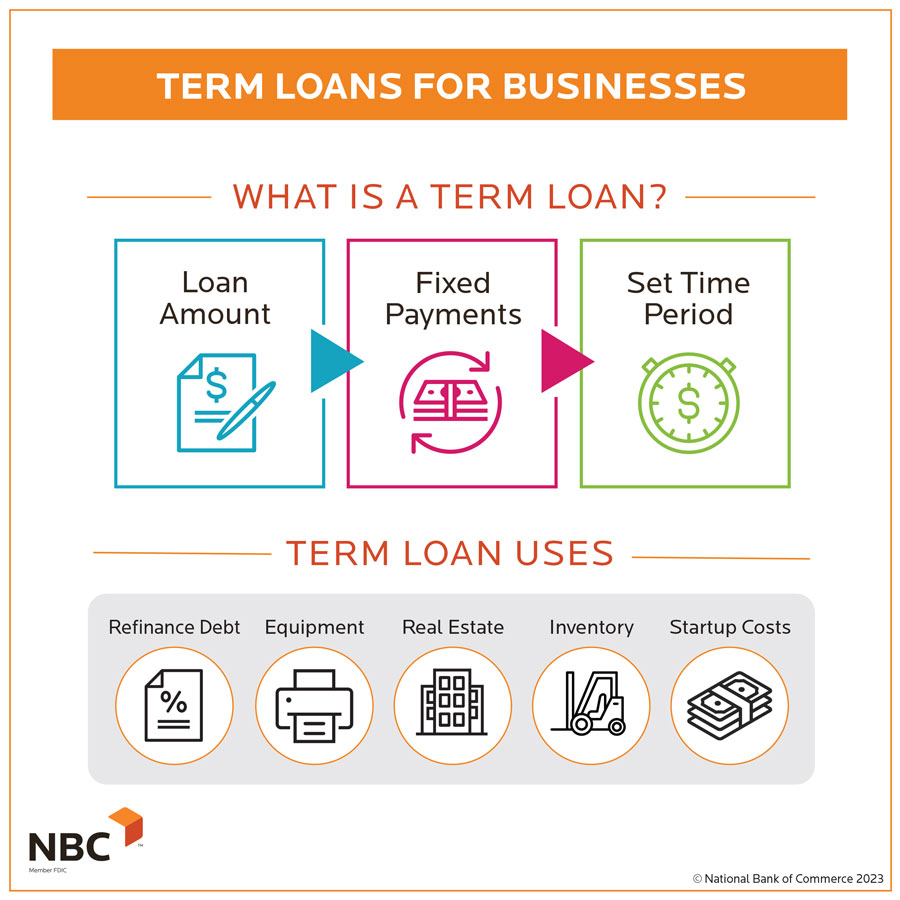

Term Loan

A term loan, also known as a commercial loan, provides a business with a lump sum of money which is repaid in regular payments over a set period.

Term loans are most often used to purchase fixed assets, such as equipment/vehicles, inventory, or real estate. However, they can also be used to fund startup costs.

How Business Term Loans Work

The amount of the term loan is usually based on the:

- Value of the assets the loan will be used to purchase

- Value of the collateral being pledged

- Borrower’s overall creditworthiness

At National Bank of Commerce (NBC), our business’s legal lending limit is $22.5 million*. This is the maximum amount we can borrow to any one entity.

*As of September 2022 (can change on a quarterly basis).

The interest rate on a term loan is usually fixed, meaning it will not change over the course of the term of the loan.

The repayment period, also known as the term length, for a term loan is typically ballooned at five years. A balloon payment is a larger, one-time payment paid at the end of a loan term. The payments for term loans are typically amortized over 20 years and is usually determined based on the “useful life” and condition of the collateral. For example, a term loan used to purchase a piece of equipment with an estimated 5-year useful life would have a repayment period of 5 years.

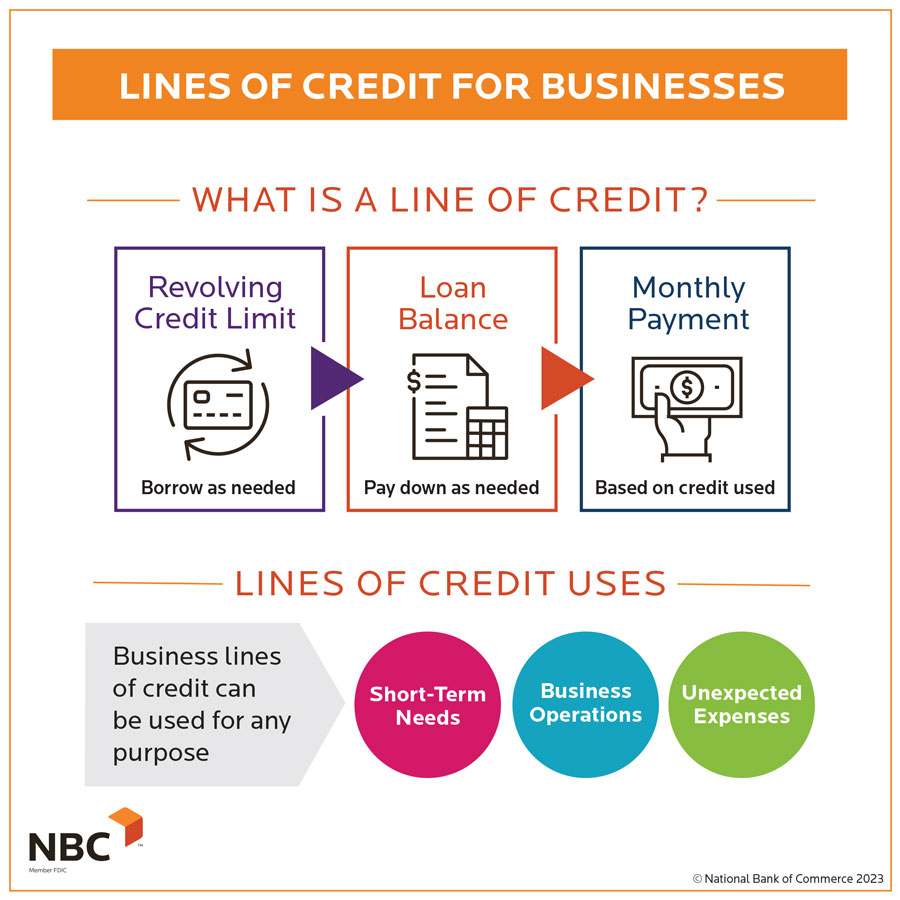

Line of Credit

A line of credit allows a business to borrow money when they need it (up to an approved limit).

This type of loan is typically “revolving,” which means you can borrow funds and pay it back as needed, as long as you don’t go above the approved amount.

Lines of credit are typically used to finance the day-to-day activities of your business (also known as working capital).

How Business Lines of Credit Work

Businesses can draw funds from their line of credit throughout the year by transferring money electronically—and pay off the balance as business operations allow.

The credit limit is usually based on the financial stability and repayment capacity of the business. At NBC, our lines of credit typically range from $50,000 to $20 Million.

Mandatory monthly payments on lines of credit are typically interest only, calculated on the outstanding balance, and normally do not include a principal.

For example, if you have a line of credit for $100,000 and use $40,000 of it, you’ll pay interest (at whatever the current market rate is) on that $40,000.

A line of credit is most often set up for 12 months so it can be reviewed annually by your lender. Often, there are no requirements on when principal needs to be fully repaid as long as the line of credit is used as intended and does not sit at a fully drawn balance.

Real Estate Loan

A real estate loan is a type of lending used to purchase, improve, or build a property for businesses. These can be structured as a term loan (most common), line of credit, or hybrid of the two.

Real Estate Term Loans:

Real estate term loans are typically used when purchasing commercial real estate. The amount of the loan will be based on the value and condition of the property and the payments are typically amortized over a 20-year period with a balloon payment usually happening at five years.

Real Estate Lines of Credit:

For the purpose of improving a property, real estate loans are typically structured as a single advance line of credit, also known as a construction loan.

A single advance line of credit can only be used one time (up to the approved limit). It does not revolve or allow a borrower to pay it down and draw from it again.

Real Estate Hybrid Loans:

A construction loan can also be a hybrid loan that starts as a single advance line of credit and converts to a term loan upon completion of the construction phase.

For example, if you are building an investment property with a 12-month construction timeline, the loan would have a 12-month interest-only period during which the funds could be used. After the 12-month period, the loan would automatically convert to a term loan.

Letter of Credit

A letter of credit is a financial guarantee from a lender to help you transact business with companies with whom you have a limited credit history. This is not a loan. Rather, it is considered a document that guarantees a specific payment will be made.

A letter of credit may be required by a vendor or supplier to ensure they are paid as contractually agreed.

How Letters of Credit Work

A bank issues a letter of credit to guarantee the payment to the seller, which is essentially taking responsibility that the seller will be paid. The buyer must prove to the bank that they have enough assets or a sufficient line of credit to pay before the bank will guarantee the payment to the seller.

SBA Loans

The Small Business Administration (SBA) is a great resource for business owners. It is a federal agency that provides financing support to entrepreneurs and small businesses in various capacities.

What are SBA Loans?

SBA loans are (partially) government-backed loans that can have lower interest rates as well as flexible repayment terms issued by participating private lenders, such as banks, credit unions, and Certified Development Companies.

The three most popular SBA loan programs are outlined below:

SBA 7(a) Loan

The 7(a) loan program is the SBA’s primary lending option because it can be used for almost any business purpose and actually includes several different types of loans to choose from—Standard 7(a) being the most popular.

7(a) loans are available for up to $5 million and maximum terms of 25 years for real estate or 10 years for equipment, working capital, or inventory—with both fixed or variable interest.

These also include an SBA guarantee of up to 85% for loans up to $150,000 and up to 75% for loans greater than that.

504 Loan

SBA 504 loans are offered through the SBA’s CDC/504 Loan Program, a specialized loan program designed for major investments like heavy equipment and commercial real estate—and job creation.

504 loans are fixed-rate loans up to $5 million and range from 10 to 25 years (up to 10 years for machinery or equipment; 20-25 years for real estate).

This program consists of two loans. One loan is provided by a Certified Development Company (CDC) like MN Business Finance Corporation or WI Business Development and the other by a third-party lender such as NBC.

The CDC provides up to 40% of the loan amount (this part is guaranteed by the SBA) and the third-party lender covers the remaining amount (must be at least 50% of the total loan amount).

504 loans also have a job creation component. Businesses must create one job per $65,000 borrowed—or $100,000 for small manufacturers. (Source)

Microloan

SBA microloans are for businesses only needing up to $50,000 that may not qualify for traditional financing.

Microloans can be used for most business purposes except debt consolidation or the purchase of real estate. (Source)

Microloans are provided through participating community-based lenders and nonprofit organizations, such as the Entrepreneur Fund, and are funded by the SBA (up to $50,000).

The interest rates on these loans are typically higher than those offered by banks or other SBA programs. The maximum repayment term allowed by the SBA is six years but may be less depending on the lender.

Eligibility and the amount you can borrow with an SBA loan vary for each type of loan program, such as the size and type of your business, the purpose of the loan, and the participating lender’s underwriting criteria.

Please refer to your commercial banker for help in determining which SBA loan type is best for your financing needs and eligibility requirements. In addition, you can visit the SBA website for more information on the outlined loan products and other resources to help your small business.

WHEDA Small Business Financing

WHEDAstands for Wisconsin Housing and Economic Development Authority, and its mission is to stimulate the state’s economy and improve the quality of life for WI residents by providing affordable housing and business financing products.

They offer the following business lending financing products:

- Small Business Loan Guarantees, which help to reduce the financial risk to lenders and ensure that qualified WI small businesses have access to funding.

- Agriculture Loan Guarantees, which reduce risk to lenders for agriculture financing needs.

- WHEDA Participation Lending Program (WPLP), which is intended to provide WI businesses with financing that could not otherwise be secured through traditional lending. The program partners WHEDA with local community participating lenders, banks, economic development corporations, and other entities that provide commercial loans in the state. Some benefits from this loan program are reduced risk for participating lenders and its availability for use during construction.

Learn more about each of these programs »

WHEDA offers additional services and products to support and encourage investment in WI’s economy. Please visit the WHEDA Website for more information.

Small Business Loans for Startups

There are many things to think about when starting a business, from what type of business entity to establish to preparing a business plan. There will be different factors and considerations based on the type of business you are starting. The process can be scary, but there are excellent resources available to support you in your new endeavor.

Both MN and WI provide new business owners with extensive information and resources. Below are links to the state’s website:

Your local Small Business Development Center (SBDC) is another great resource available to assist with your start-up:

Other local resources include the Entrepreneur Fund and the Northland Foundation.

During the beginning stages of strategic planning for your new business, it is always a great idea to have discussions with your financial experts to ensure you are choosing the correct business type, preparing projections, and accurately determining your capital needs. Capital needs are funds required for start-up costs and initial working capital to get your business going. Discussing your plans, needs, and wants with your banker will ensure you get your business started on the right foot.

Small Business Grants in

MN & WI

A small business grant is money given to a business for a specific use based on eligibility requirements. There are various grants available in MN and WI – the grants that a business would be eligible for will depend on the state in which your business operates. In addition, each grant has very specific eligibility requirements.

Grant options and availability are always changing. Please speak to your NBC commercial banker or check with your local state resources for available grants and eligibility.

How to Choose the Right Loan Option

There are many different loan options and financing structures. Although the information provided in this blog can help guide you to the right loan product for your specific business or project, it is always a best practice to consult with your NBC commercial banker to ensure the best fit for you and your business.

Discover the different types of loans,

WATCH OUR VIDEO

Conclusion

Now that we’ve learned how business loans work, as well as the various lending products available to business owners, it’s time to pull back the curtain and take a closer look at the components of a business loan. Module #3 does just that. And it’s next.

Other Articles in this Guide

How Business Loans Work

Learn what business loans are, how to apply for them, how a lender determines how much you can borrow, and how long the process may take.

Components of a Business Loan

Discover the five major components of a business loan, what each entails, and what you need to consider when applying.

Business Lending Requirements

Gain insight into the documents required for a business loan, qualifying (and disqualifying) factors, and even what to do if you’re denied.

You’re Approved, Now What?

Discover what happens after you’re approved for a business loan, what steps you’ll need to take to close, and how funding, payments and annual loan maintenance works.